Threefold governance

The Observatory's new governance structure is based around three committees with distinct prerogatives, and aims to ensure its ethical and financial stability, the scientific rigor of its studies and the independence of its publications.

The PARC Strategic Orientation Committee

- Paris Agreement Research Commons (PARC) is a foundation under the auspices of the Fondation du Risque. Its founding members are the Institut Louis Bachelier, ADEME, the French Treasury, the European Climate Foundation, the Ecole des Ponts ParisTech and the Institute of Actuaries.

- PARC's Strategic Orientation Committee ensures that the Observatory's values and mission of public utility are respected.

The Scientific and Expert Committee

- A dedicated group within the PARC Foundation's Scientific and Expert Council, it is made up of leading figures from academic research, think-tanks, NGOs, etc.

- It ensures that the Observatory's publications are methodologically rigorous. It has a say in the methodologies used in the studies and monitoring tables provided in open access, and is involved in all new studies and issues recommendations.

- Find out more about the Scientific and Expertise Committee

The Observatory's Executive Committee

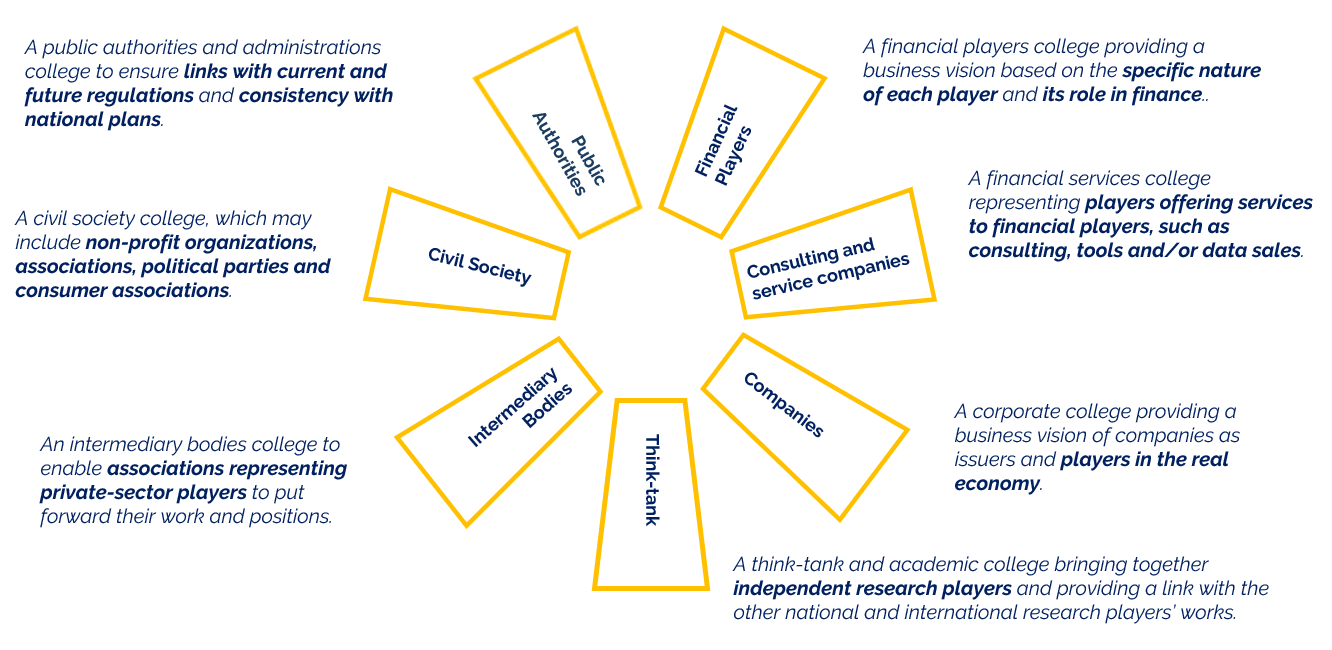

- Made up of members of the Observatory, it is divided into seven colleges:

- The Executive Committee validates the Observatory's annual plan, examines and validates new research projects hosted by the Observatory and the associated funding. It meets in plenary session two times a year, excluding exceptional meetings.

- The Observatory is independent of its members and does not represent them.

- ADEME and the Fondation du Risque are founding members of the Observatory. The Fondation du Risque, which hosts the Observatory, sits alongside the Observatory's Managing Director.

How the Observatory works

Studies

- As part of its mission to monitor and promote transparency in the financial sector, the Observatory hosts a number of studies which result in publications and data display tables that are freely accessible on the Observatory's website.

- These studies are initiated by the Observatory's members and validated by the triple governance.

Working groups

- A working group is set up for each study (e.g. Net-Zero Donut). Observatory members wishing to get involved in the monitoring and analysis of ongoing studies can take part in a group.

Methodologies

- The Scientific and Expertise Council (SEC) is responsible for the methodologies developed by the Observatory's staff as part of the studies. A dedicated Observatory employee with a scientific background is responsible for coordinating the work of the SCE.

- Find out more about our methodologies

Publications

- The Observatory's publications do not necessarily represent the opinions of its members. Analyses and recommendations are subject to consultation by members and the SEC, but their content remains at the discretion of the Observatory's Director General. When a study is co-financed by a member, that member may be involved in validating the publications.

- Our publications

Why an Observatory?

Why an Observatory?