The Net-Zero Donut methodology

Presentation

The Net-Zero Donut study focuses on the following three major Net-Zero alliances:

- The Net-Zero Asset Managers initiative, totaling about USD 57 trillion in assets

- The Net-Zero Asset Owner Alliance, totaling about USD 9 trillion in assets

- The Net-Zero Banking Alliance, totaling about USD 74 trillion in assets

The aim of the study is to highlight the asymmetries between the practices and recommendations of the GFANZ, the alliances and their signatory members, and other existing voluntary and regulatory reporting frameworks, in order to propose all the indicators needed for the proper internal and external monitoring of a Net-Zero commitment.

It is based on the general GFANZ framework and its 5 main pillars: Foundations, Governance, Implementation Strategy, Engagement Strategy and Metrics & Objectives, to which a Performance and Measurement pillar was added for further transparency.

This study is conducted on an evolving perimeter of financial institutions, which started with French institutions in its first year and will continue to grow with each instance.

The data collection and analyses carried out as part of the Net-Zero Donut are the fruit of human endeavour. It is possible that some data points may have escaped the attention of the analysts who worked on the project, which is why we specify ‘not found’ rather than ‘not reported’. That said, these shortcomings cannot always be attributed solely to human error, but also to the clarity of the presentation of information in the reports and corresponding policies of the players. Indeed, the accessibility of information plays a vital role in stakeholders' understanding of NZ targets, which is why we are calling for the publication of an annual public document bringing together all the data related to NZ ambition.

Reading keys

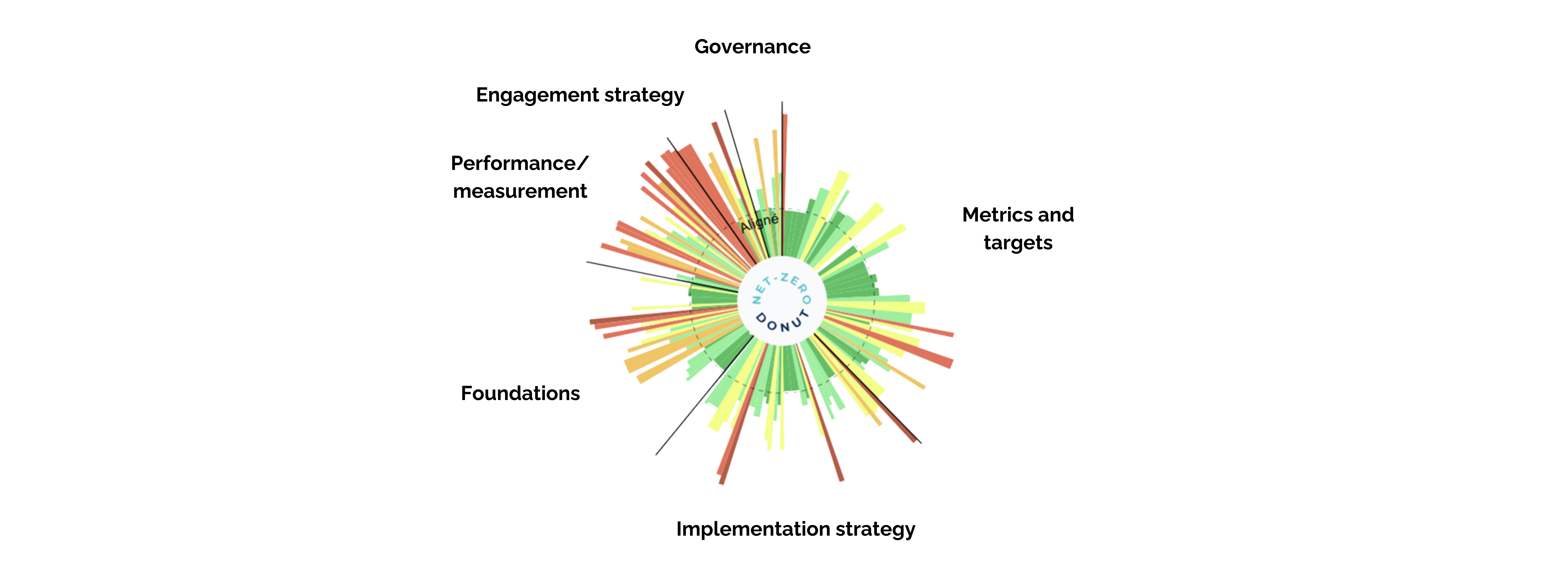

- The Net-Zero Donut is made up of all the indicators selected for each alliance, represented by a coloured area and classified into the 6 categories the framework.

- It is available for the financial institutions themselves, and in aggregated form for alliances.

- Each indicator is modelled by a thin slice representing the alignment or misalignment of the financial player with the reference framework, and respects the following colour code:

- Data found and evaluated: from Red to Green

- Data found but without a reference framework: Purple

- Data not found: Grey

- Indicator not applicable to the actor: White

- The indicator's width depends to its relative importance, established by the number of external framework used that mentions them.

- The dotted circle represents the target to be reached. It delimits the area of the ideal donut for a financial institution analysed through the prism of the Net-Zero Donut.

Building the Net-Zero Donut framework

Use of reference frameworks

The indicators used for the construction of the Net-Zero Donut come from a variety of sources, according to their relevance to the study. Indicators are either directly adapted from an external framework’s recommendations or derived from the Observatory’s other studies. Each indicator is weighed according to the number of external frameworks they are referenced in.

Call to PARC's Scientific and Expertise committee

The framework was reviewed by PARC's Scientific and Expertise committee, to guarantee the methodological soundness of the study. The committee members participated in the overall definition of the final indicators as well as their evaluation frameworks.

To understand how it was constructed, dive into the methodology !

Glossary

Glossary