PDF version

Individual commitments guide

Download the file

Table of contents

1/ Presentation of the Sustainable Finance Observatory

2/ Rules for the publication of commitments

3/ Definition of a commitment

4/ Classification of commitments and glossary

1/ Presentation of the Sustainable Finance Observatory

On the occasion of the public meeting held on July 2, 2019 at the request and in the presence of the Minister of the Economy and Finance, Bruno Le Maire, the main professional organizations and federations representing the Paris financial center announced, in a joint statement, new commitments in favor of the fight against climate change and to contribute to the objective of carbon neutrality by 2050:

- Encourage members to adopt a coal strategy, with an overall timetable for divestment, and to report it in their non-financial reporting for the 2020 financial year.

- Continue methodological work in collaboration with supervisory authorities on the assessment of portfolio exposure to climate risks and the alignment of investment portfolios with a 2°C scenario. The Paris financial center will promote the dissemination and open source standardization of these methodologies.

- Promote the monitoring of commitments made and communicated by financial actors as well as the achievements and actions in terms of green and sustainable finance, through the creation of an Observatory.

With a scientific and expert committee, the Observatory is jointly managed by the main professional federations (AFG, FBF, FFA, France Invest) and by Finance for Tomorrow.

The Observatory presents two types of information :

This guide will ensure greater consistency in the presentation of commitments made by financial actors in terms of sustainable finance, in order to ensure greater clarity and homogeneity following the recommendations of the AMF and the ACPR in 2020.1 This guide is intended to support financial actors who already report their commitments, as well as those who wish to take part in this transparency process.

This guide will be regularly updated to reflect changes in the recommendations of the Observatory's Scientific and Expert Committee and the classifications of AMF and ACPR.

2/ Rules for the publication of commitments

When a financial actor chooses to report its commitments, it therefore accepts the republication on the Observatory's website and undertakes to :

- Report annually to the Observatory the completeness of the commitments made and communicated concerning sustainable finance, on the three perimeters (environment, social & societal and governance) described in part 4 of this guide.

- Report any updates or new commitments, if possible at the time of their public communication, and at least once a year, before March 31.

- Each commitment must specify the date on which it was publicly announced as well as a precise URL referring to the page of the website where the commitment was communicated (e.g. website, report, press release).

- The annual update of the commitments and the reporting of the follow-up can be done by sending the relevant parts of the AMF/ACPR questionnaire to the Observatory or by filling in a dedicated questionnaire, transmitted by the Observatory, indicating a precise url as well as the page of the report concerned where to find the commitment and/or the information on its follow-up In both cases, the Observatory will validate with your identified contact the scope of the data before publication.

- Report annually to the Observatory, starting in year N+1 after the public announcement of the commitment, the information needed to monitor its commitments. The monitoring information shall cover both the means implemented and the results obtained.

- Subsidiaries of groups should disclose not only their own commitments but also the group commitments that apply to their entity.

- Use the definitions of the European Taxonomy as of the entry into force of the relevant European regulation for all new commitments relating to "green" investments or financing.

- Use the definitions of the Observatory's glossary in the formulation of commitments, whenever possible.

- Indicate a contact person for the Observatory.

3/ Definition of a commitment

The Observatory's steering committee has defined five minimum criteria that must be met for a statement to be considered as a full commitment. Compliance with the minimum criteria ensures that commitments are easy to read and understandable. Statements that do not comply with criteria are published on the Observatory's website but are identified as such.

Minimum criteria to be respected:

- Classification: the commitment must be related to one of the Environment, Social & Societal or Governance components, and belong to one of the categories of the Observatory's classification specified in part 4/.

- Activities of the actor concerned by the commitment: The entity's activities concerned by the commitment (asset classes or financial activities to which the commitment applies, etc...) must be specified.

- Scope of the commitment: The scope of the activities and elements covered by the commitments must be described precisely. Generic terms such as "green activities" are not compliant. Examples: in the case of sectoral exclusion policies, the commitment must clearly specify which activities in the value chain are excluded (production, distribution, etc.). In the case of the publication of a carbon footprint, the scope must be specified.

- Timeframe: the commitment must have an implementation date and a final completion date. If the commitment is ongoing or repeats at a defined frequency, details must be stated.

The following criteria constitute good practices. Financial actors are encouraged to consider them for future commitments:

- Timeline for a long commitment (over 5 years): the commitment should include intermediate dates and be broken down into several intermediate objectives;

- Monitoring procedures: the initial situation must be indicated as well as its monitoring. The monitoring methodology must be indicated;

- Use of the Observatory's glossary and existing standards such as the European Taxonomy definitions;

- Specification of the means implemented to achieve the commitment;

- Intelligibility: information allowing to understand the impact of the commitment, the binding or obligatory aspect can be explained;

- Audit by an independent third party;

- Putting into perspective in relation to the company's overall activity.

The following are not considered commitments:

- Participation in local working groups or events unless participation is conditional on signing a commitment charter.

Examples of commitments

- General commitment:

From (date), the company (name) commits to (commitment) with the objective of reaching (percentage or euro threshold) in (date). This commitment applies to (choice of assets concerned/all activities of the entity).

- Specific cases of certain commitments:

Exclusion policy : From (date), the company (name) commits to progressively exclude coal/non-conventional fossil fuels within the scope of (choice of activities in the sector's value chain - distribution, production, exploration...). In (date), the exclusion thresholds are set (at X%), and will be progressively lowered to reach a final exit in (date). This commitment covers (choice of assets concerned/all of the entity's financial activities).

Product offer : Since (date), Company X has been offering a (name of the Label) on (choice of assets concerned/all of the entity's financial activities) and undertakes to (increase or maintain) this offer (at the threshold in % or in EUR bn) by (date).

Permanent commitment : The company X commits to (conduct ESG/climate analysis) on (X% of portfolio/choice of assets involved/all financial activities of entity). This commitment is permanent.

4/ Classification of commitments and glossary

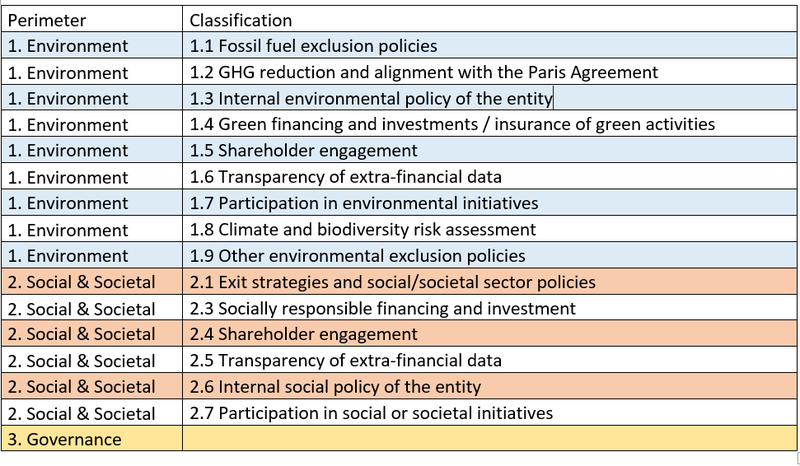

The individual commitments of the players are classified according to the classification presented below. It is divided into three main areas: Environment, Social & Societal and Governance.

The "Environment" classification is aligned with the one used by the AMF and the ACPR in their annual surveys for the joint ACPR-AMF report on the monitoring of the climate commitments of French financial institutions.

Glossary

Glossary